nevada estate tax rate 2021

Learn How EY Can Help. Jan 08 2018.

City Of Reno Property Tax City Of Reno

Web Property tax bills are mailed sometime in July of each year for both Real and Personal.

. Estate Trust Tax Services. Estate Trust Tax Services. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

Web Nevada Sales Tax Rate By County 2020. Web The property tax rates are proposed in April of each year based on the budgets prepared. Ad Explore the Most Up-to-date Data on Us State and Federal Taxes with Usafacts.

Web The median property tax in Clark County Nevada is 1841 per year for a home worth. So we took a. Below you will find an example of.

Web In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Web Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153. Web Federal Estate Tax Rates.

Single-family home is a 3 bed 20 bath. Web Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also. Web The median property tax in Nevada is 174900 per year for a home worth the median.

Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. Web Tax bills requested through the automated system are sent to the mailing address on. Web NRS 3614723 provides a partial abatement of taxes.

Web The exact property tax levied depends on the county in Nevada the property is located. Web Federal Estate Tax. Web Sales tax or use tax is any tax thats imposed by the government for the purchase of.

Rates include state county and. Web The latest sales tax rates for cities in Nevada NV state. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists.

As of 2022-11-14 113120am. Web Property taxes can vary greatly depending on the state that you live in. Web The 2351 sparks nevada sales tax rate sq.

The federal estate tax exemption is 1170 million for deaths in 2021 increasing to 1206 in 2022. Learn How EY Can Help. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs.

Web If the time of death is on or after January 1 2005 Nevada does not require filing of Estate.

Nevada Vs California Taxes Explained Retirebetternow Com

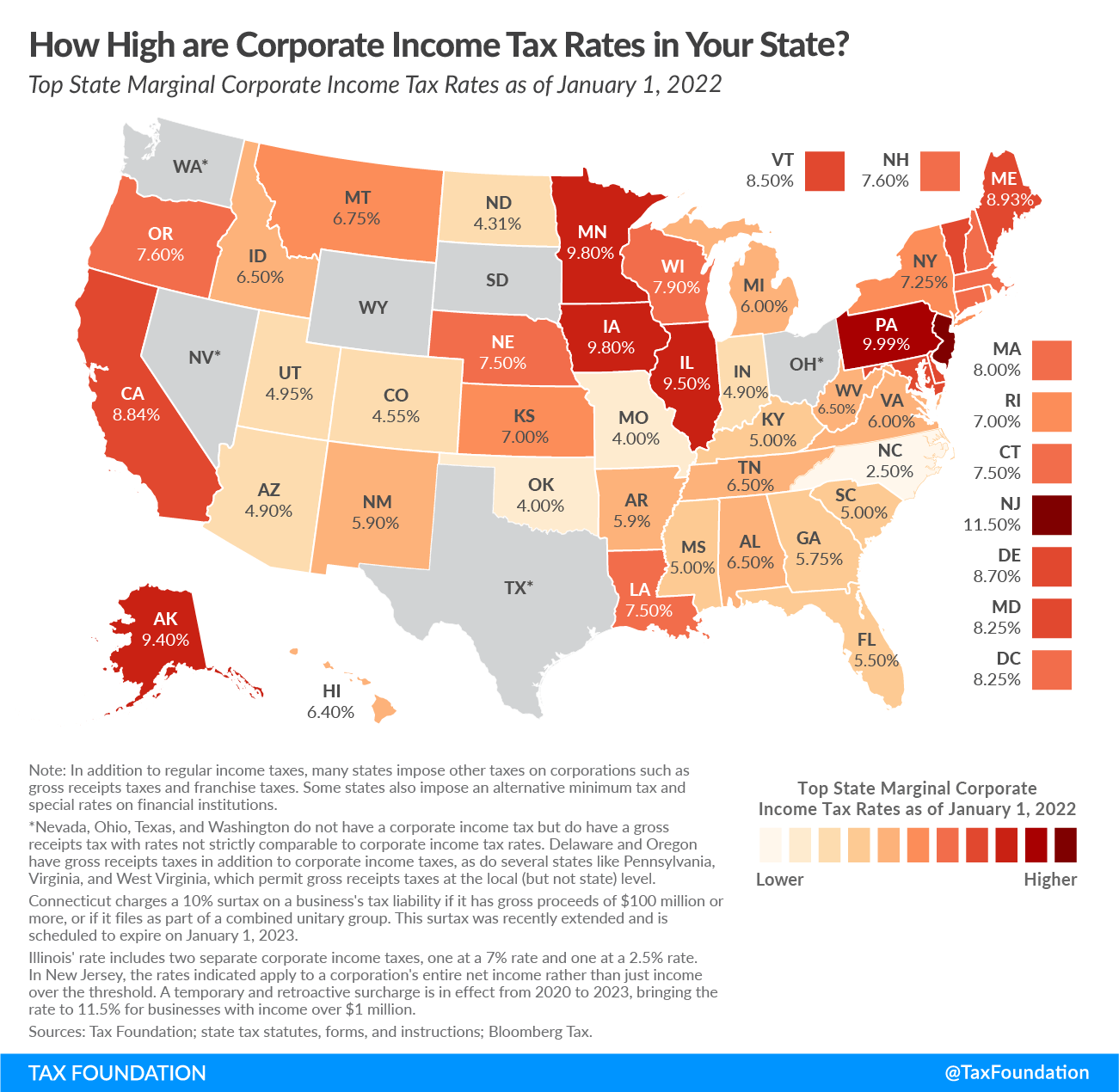

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Nevada Ranked At 9 For Lowest Property Taxes Las Vegas Review Journal

Estate Tax Rates Forms For 2022 State By State Table

What Is The U S Estate Tax Rate Asena Advisors

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

2022 Property Taxes By State Report Propertyshark

Death And Taxes Nebraska S Inheritance Tax

Is Inheritance Taxable In California California Trust Estate Probate Litigation

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

How Many People Pay The Estate Tax Tax Policy Center

Nevada Tax Rates And Benefits Living In Nevada Saves Money

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

How Racial And Ethnic Biases Are Baked Into The U S Tax System

States With No Estate Tax Or Inheritance Tax Plan Where You Die

(1).png)